ct sales tax exemptions

Constitution should file a state corporate net income tax report. Available for Retail Sales and Use Tax Form ST-9 for in-state dealers and Form ST-8 for out-of-state dealers and Digital Media Fee Form DM-1.

On this page we have compiled a calendar of all sales tax due dates for Connecticut broken down by filing frequency.

. 2022 Town Revaluation Project CREDIT FOR PERSONS 65 OVER. Town Assessor Justin Feldman CCMA II Email. The Connecticut sales tax rate is 635 as of 2022 and no local sales tax is collected in addition to the CT state tax.

Filing for an Extension of Time to File. Depending on the volume of sales taxes you collect and the status of your sales tax account with Connecticut you may be required to file sales tax returns on a monthly semi-monthly quarterly semi-annual or annual basis. Web Upload - Web Upload is file driven with the ability to save all return and payment information into a single file to send to Virginia Tax.

The utility service use tax is due monthly with returns and remittances to be filed through the My Alabama Taxes MAT filing system on or before the 20th day of the month for the previous months sales. Nebraska Net Taxable Sales and Use Tax Worksheets. Assembly Bill 6376 Introduced in 2007.

Town Appraiser David Lisowski CCMA II Phone. Ministry of Finance Tax Bulletin ISSUED. Fill out your Connecticut sales and use tax return.

April 2021 Bulletin MFT-CT 005 govbccasalestaxes PO Box 9447 Stn Prov Govt Victoria BC V8W 9V7 Tax Rates on Fuels Motor Fuel Tax Act and Carbon Tax Act. Monthly - On or before the 20th of the month for the preceding month. Net Taxable Sales Worksheet 1.

Due date of payment is 61. Use Form CT-1040 EXT to request a six-month extension to file your Connecticut income tax return. Exemptions and tax relief provisions.

Applicable sales tax rate 1 2 99 6 35 or 7 75 10. The rate of tax against the sales price of such telegraph services or telephone services in the State of Alabama is 6 on all gross sales or gross receipts. Department of Revenue Services.

Localities in New York may charge additional local sales taxes of up to 475 for a total rate of up to 875. A The term sales price applies to the measure subject to sales tax and means the total amount of consideration including cash credit property and services for which personal property or services are sold leased or rented valued in money whether received in money or otherwise without any deduction for the following. Exemptions to the Connecticut sales tax will vary by state.

Connecticut has a 635 statewide sales tax rate and does not allow local governments to collect sales taxesThis means that the applicable sales tax rate is. Sales and Use Tax Form OS-114. CT-1 INSTRUCTIONS REV-1200 Booklet SU 04-21 Page 1 of RCT-101 contains a checkbox labeled Section 381382 Alternate.

You must be 65 years of age or older by December 31 2021. Use the envelope we provide with your bill or send your payment to our office at City of Torrington Tax Collector 140 Main Street Room 134 Torrington CT 06790. New York s state sales tax rate is 4.

The assessors office is responsible for maintaining an accurate description of all real personal and motor vehicle property in the town determining and recording the assessed value of each property and for calculating and annually reporting the Towns grand list the total assessment of all taxable property in the town. The July 2021 Tax Bills will be based on the 2020 Grand List covering the assessment year October 1 2020 through September 30 2021 and are paid during the fiscal year running. In order to qualify.

If goods or services are purchased for use in Connecticut and the tax paid in the other state is less than the Connecticut tax you must report and. Annually - Due date of the return is 31 filed in the Locality. Services of self-employed welder exempt from sales tax.

Sales of nontaxable services as shown in Regulation 1-012 B. Such beverages along with candy and confectionery are currently subject to New York sales tax. For recent sales information click HERE.

Gross Sales and Services in Nebraska Line 1 Form 10. Free Assistance Locations. Assessors Office Town of Monroe 7 Fan Hill Rd Monroe CT 06468.

What if I buy taxable goods or services in another state and the vendor charges sales tax for the other state. The Ridgefield Assessors office is accepting applications from qualified homeowners for the Town Program for Tax Relief from January 1 2022 through April 1 2022. Upcoming Tax Bills The Mill Rate for the 2020 Grand List is the same as last year 3138.

Monthly - On or before the 20th of the month for the preceding month. Please note that we have to use the US Postmark on an envelope to determine when and how to. Taxpayers that meet the minimum constitutional nexus standards must begin filing corporate tax reports for periods starting on or after January 1 2020.

ALLOWABLE EXEMPTIONS AND DEDUCTIONS FROM GROSS SALES. Sales tax to be collected if at all at time of original transfer. 203 452-2800 Ext 1004 Email.

Exemptions Tax Relief Tbd Phone. 203 452-2800 Ext 1004 or 1005 Email. Locality files with TAX by 320.

Sales Taxes Association For New Canadians Nl

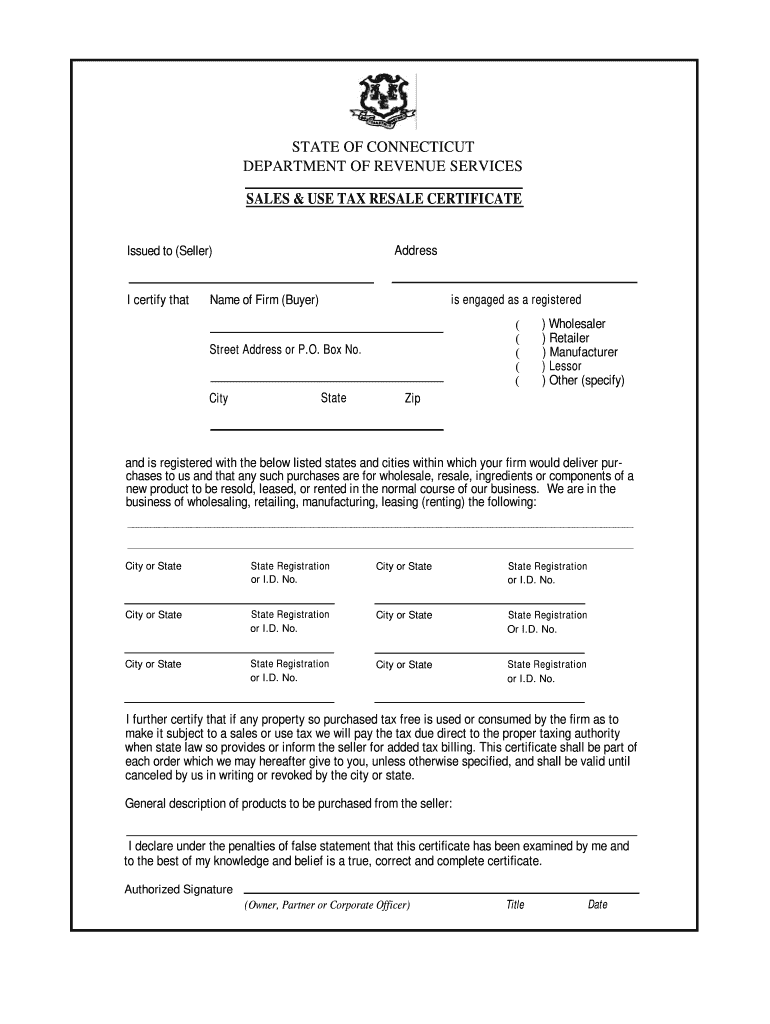

Ct Sales Use Tax Resale Cerfiticate Fill Out Tax Template Online Us Legal Forms

Sales Tax Exemption For Building Materials Used In State Construction Projects

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com